🧓Pensions

Pension Triple Lock

Upfront

+£50m

Annual

-£15.5bn

Revenue

£0m

Net Annual Effect

-£15.5bn/year

Payback in 1 years

GDP +0.05%low uncertainty

2 sourcesOBR-endorsed

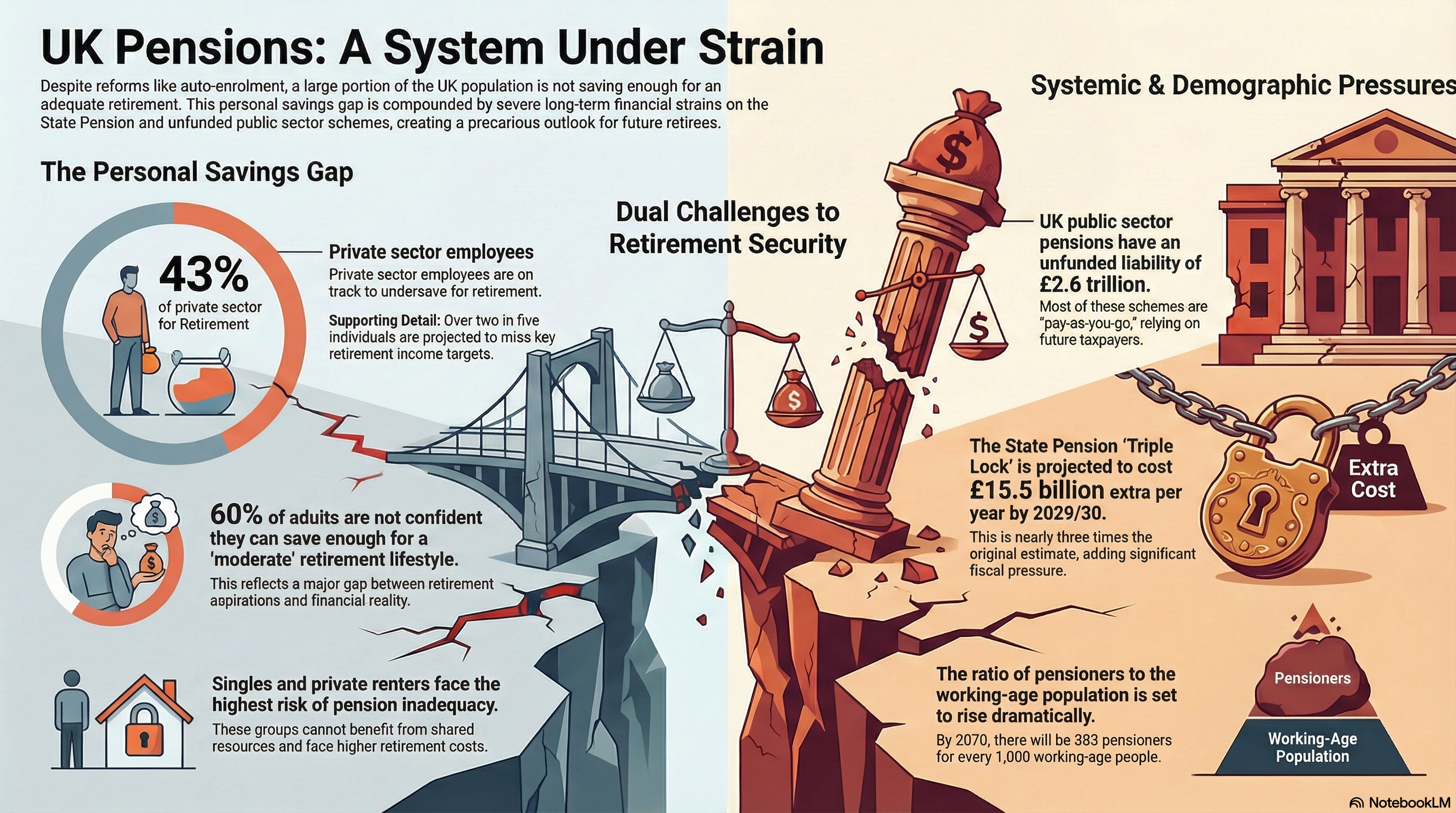

Triple lock £15.5bn/yr - pensioners got 8.5% while workers got 0%

43% undersaving - £48-57k pot vs £489k needed

State pension age 66 but life expectancy 81 - maths broken

Pensioner households now RICHER than working households

EARNINGS-LINK ONLY: Replace triple lock, save £15.5bn/yr (pre-2011 norm)

ALIGN PENSION AGE to longevity: 68 by 2030, 70 by 2040 (Denmark model)

TARGETED BENEFITS: Means-test universal pensioner benefits (New Zealand model)

AUTO-ENROL at 12%: Adequate savings mandate (Australia model)

Reforms in Pensions & Retirement will have downstream effects on 2 connected domains:

Rigorous fiscal analysis of Pensions & Retirement reforms